The title for this post was tough to write. Some people will disagree that AI is even a bubble, so no matter what I say after this, I have pissed them off. I hope they’ll take this disclaimer as a mini apology.

In the context of this post, I’ll talk about the “bubble” from the mainstream, Western markets perspective. AI has driven almost all major stock market growth in the US during 2024 and 2025. As we enter 2026, there’s already more than a few cracks for these market leaders to worry about.

Shareholders Dislike AI CapEx Plans

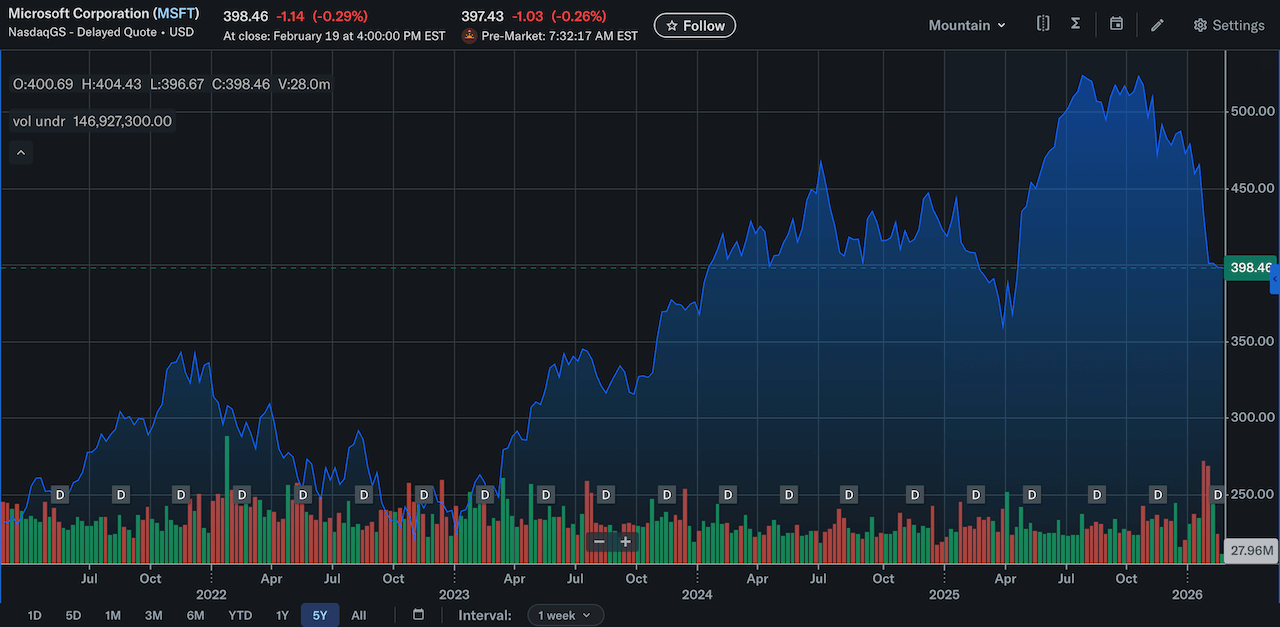

This February, Microsoft stock plummeted despite a very strong quarter. While the company’s 47% operating margins and 26% cloud revenue growth look impressive, their CapEx plan for AI expansion has investors worried. Here’s my understanding of the situation: investors expected to see projections for Azure to grow, but infrastructure CapEx is going towards supporting internal AI offerings and R&D. The side-effect is that the market is reacting proactively—Azure won’t grow as expected in 2026 and trust in AI-driven revenue making up for it is low. The overreliance on OpenAI, which is starting to look unreasonable, is also shaking investor trust.

But I have to imagine Microsoft leadership knew this. They know they have a responsibility to keep investors happy, but not at all costs. They made a bold bet in 2025, and they’ve just doubled down. Time will tell.

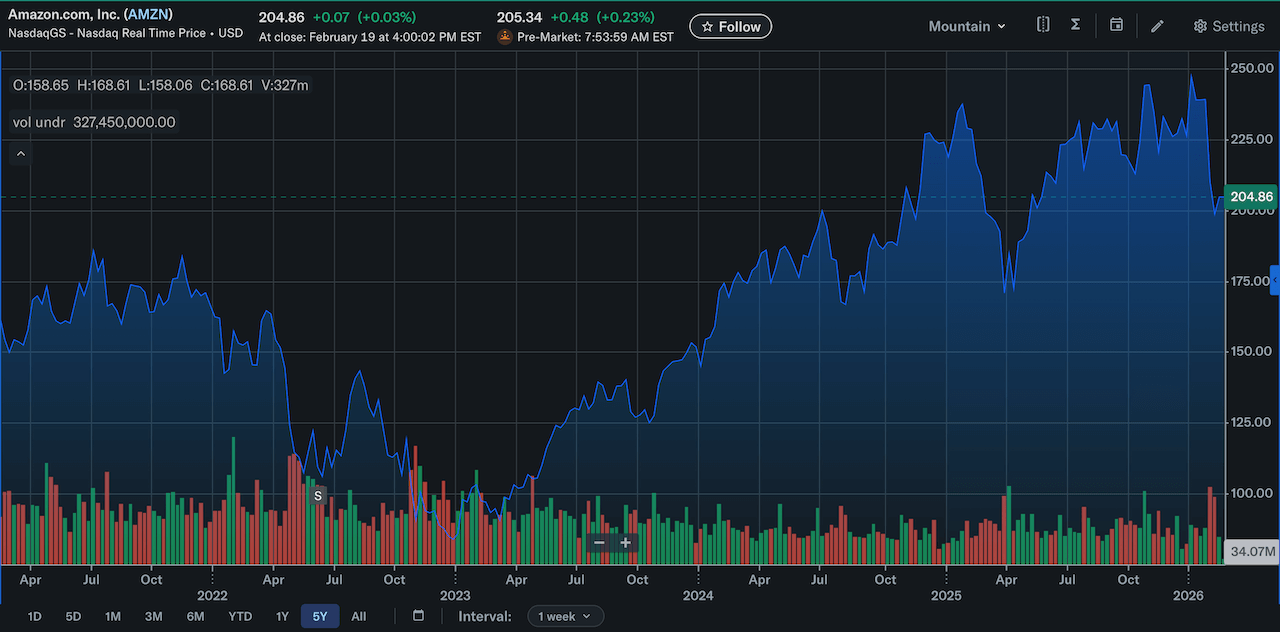

Amazon is in a similar boat. A record quarter, with brilliant earnings, but the commitment of 200B of CapEx for AI infrastructure is a serious concern. Investors are not happy, to say the least. Berkshire Hathaway (still under Warren Buffett), responded by selling 7.7M shares. Ouch.

Bottom line: investors don’t think leaders are being reasonable with AI CapEx plans. They are punishing these tech giants for going overboard. (As they see it.)

China Approaches

China’s push for “AI sovereignty” is the real deal. Huawei is leading the pack with its Ascend chips. The recent GLM-5 model by Zhipu AI (Z.ai), was trained entirely on these chips, and customers love what Z.ai delivered with it. It’s a model that’s competitive with the latest models from Anthropic, Google, and OpenAI, while having the benefit of being released as open-source. And thus being cheaper. Much cheaper.

Consider these costs:

| Model | Price per 1M input tokens | Price per 1M output tokens |

|---|---|---|

| Claude Opus 4.6 | $5 | $25 |

| Claude Sonnet 4.6 | $3 | $15 |

| Gemini Pro 3.1 | $2 | $12 |

| GPT 5.2 Codex | $1.75 | $14 |

| Kimi K2.5 [1] | $0.23 | $3 |

| GLM-5 | $0.30 | $2.55 |

[1] Kimi K2.5 is also a recent Chinese model. I use it a lot. You can read my review of it here.

Now, it’s important to clarify that nobody is seriously suggesting that GLM-5 or K2.5 are better than Opus or Codex, but, as I said, they are highly competitive. For a great deal of use-cases, including coding, users will not notice a difference, yet their wallet will certainly notice a 92-79% decrease in cost!

Bottom line: the market is healthy, as there’s high demand and a lot of competition to fill the supply. But the dominance of Western tech giants is looking shaky.

Still Just Selling Shovels

Who is actually paying for inference? And what are they using it for? What value are they delivering?

Software developers, using coding agents, and regular consumers using AI chat applications are the two verticals anyone reading my blog would immediately think of. Here’s where AI is coming into the picture in other industries:

- Healthcare: document management, summarization, note-taking, pre and post care communication, and imaging analysis.

- Finance and Banking: fraud detection, customer service, credit risk evaluation, and data analysis assistance.

- Legal: case discovery review, research and summarization, first draft generation, and contract review assistance.

- Retail: image generation, recommendation engines, and customer support.

In 2025, across all these industries, and many others, the total AI spend—which includes labour and not just inference, has totaled somewhere between 37—50B. Those are the most optimistic numbers I could find. So, who is the 200B+ investment in Hyperscaler CapEx going to power?

Bottom line: As of 2026, this entire industry is—still—primarily selling shovels. Software engineering has fundamentally changed forever, but the day-to-day of a lawyer, accountant, doctor, and store manager has not. Tech giants say that it will—that this change is just around the corner. Is it? That’s on you to decide, and depending on your answer, we are either in a bubble or we are not.

Will the AI Bubble Burst in 2026?

Unlikely. I don’t think it will ever truly burst. That being said, here’s the warning signs I am keeping an eye for:

- NVIDIA is posting its results on 02/25. These are important for the overall health of the industry. If the earnings call is bad, it will ripple across the industry.

- Watch for Big Tech insider trading. So far, none of them have dumped any stock, signaling confidence.

- China’s chip industry is rising, and the way they are eating at Big Tech’s profit margins is a risk for their current economic model.

- LLM may be close to plateauing. We are hearing warning signs from researchers that we can’t expect any more major leaps from this technology. If this is true, it will wreck the market.

- Regulatory crackdowns could slow down adoption, making it difficult for Hyperscalers to hit revenue targets on time, to cover their CapEx.

What I Know I am Getting Wrong

The way I am throwing around CapEx numbers and not taking about annual depreciation is almost certainly wrong. There’s also a lot of money changing hands in consumer hardware. If you want to counter the points in this post, start from there. I’d love to be educated more on that, honestly.

Anyway, clearly, I am not a financial expert, but doesn’t stop me from being wrong on the Internet. I hope this was a fun (or provoking?) read if you made it this far.

Don’t forget to diversify your investments,

—Filip